Summary: This article will analyze the historical relationship between the global M2 money supply and the cryptocurrency market, and discuss the recent shift in this correlation.

Everyone knows that crypto is a volatile asset. But not many people know that the crypto market can be influenced by macroeconomic factors like the global money supply?

This article is a must-read for everyone to better understand the correlation, make informed investment decisions, and choose the right time to enter the market.

Table of Contents

M2: A Key Indicator for the Crypto Market?

The M2 money supply is a measure of the amount of money circulating in the economy, including cash, deposits, savings deposits, and time deposits held by households. Tracking the M2 supply is more accurate than M0, M1, and M3. Besides the global M2 supply, you can also track the US M2 supply.

Naturally, the global M2 money supply is a predictive indicator for the crypto market. Why is that? Because the M2 supply reflects global liquidity. When global liquidity increases, both professional and individual investors have more money to allocate, allowing them to invest in riskier assets like cryptocurrencies.

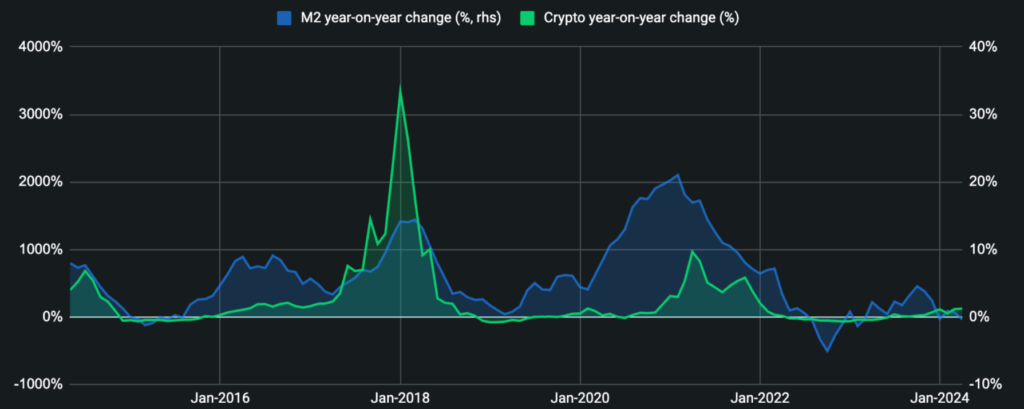

For example, in 2017 and 2021, the year-on-year change in the global M2 money supply preceded the year-on-year change in the total market capitalization of cryptocurrencies. This indicates a strong correlation between the two factors.

The Unexpected Shift: M2 Decreases, Crypto Still Rises?

However, recently, the year-on-year change in the crypto market has started to diverge from the change in the M2 money supply.

Interesting fact: The year-on-year change in the M2 money supply started to decline in October 2023, while the year-on-year change in the crypto market continued to rise.

Reason: This could be due to the optimistic news surrounding Bitcoin and Ethereum ETFs, leading investors to expect increased capital inflows into the crypto market.

The Question Remains

Is there another reason for this recent divergence? Or is the crypto market overly optimistic about the return of new capital without support from global liquidity?

According to Click Digital, closely monitoring the relationship between the M2 money supply and the crypto market is crucial. This information can help us better understand market dynamics and make more effective investment decisions.

Note: The relationship between the M2 money supply and the crypto market is a complex topic and can change over time. Always stay updated on market news and seek professional advice before making investment decisions.

Digital Marketing Specialist