Recently, a bill establishing a Bitcoin Purchase Program initiated by the U.S. Treasury Secretary was passed. What does this mean for the crypto market? Let’s break it down with Click Digital.

Table of Contents

What is the Bitcoin Purchase Program?

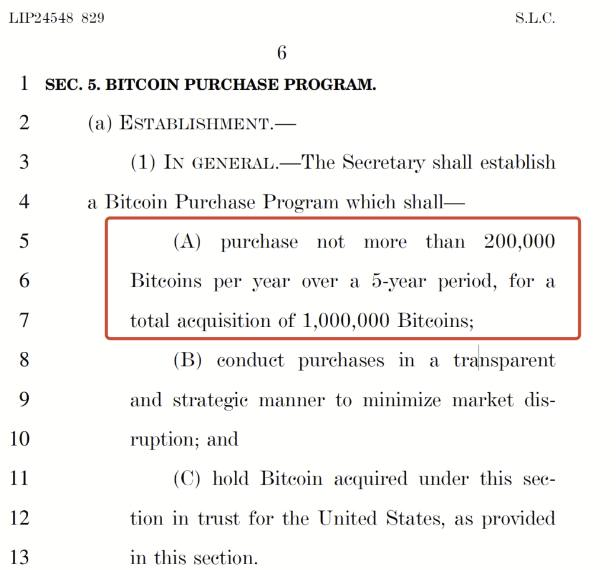

According to the new legislation, the Treasury Secretary will create a Bitcoin Purchase Program, whereby the government will purchase no more than 200,000 Bitcoin annually for five years, totaling a maximum acquisition of 1,000,000 Bitcoin. These purchases will be conducted transparently and strategically to minimize market disruption.

The Impact of the Bitcoin Purchase Program on the Crypto Market

- Positive Market Signal: The U.S. government publicly buying Bitcoin is a strong signal of recognition for the crypto market, signaling that it views Bitcoin as a valuable asset.

- Bitcoin Price Increase: Large-scale Bitcoin purchases could push Bitcoin’s price up in the future. Imagine, if the U.S. government buys 200,000 Bitcoin per year for five years, they would own 1 million Bitcoin, representing approximately 1.8% of the total Bitcoin in circulation!

- Altcoin Price Impact: The Bitcoin Purchase Program could trigger price increases in other cryptocurrencies (altcoins), as the market sentiment shifts positively.

- U.S. DCA Strategy: Buying Bitcoin over time can be seen as a Dollar-Cost Averaging (DCA) strategy employed by the U.S. government, helping to mitigate risk and enhance long-term profits. The U.S. government, with its vast financial resources, could purchase Bitcoin at lower prices and sell at higher prices in the future, generating substantial gains.

Is the Bitcoin Purchase Program Truly Effective?

Everyone knows that Bitcoin has experienced volatile price swings in the past. Will the Bitcoin Purchase Program stabilize Bitcoin’s price and drive the growth of the crypto market?

According to Click Digital, government purchases of Bitcoin could inspire confidence among crypto investors and enhance market liquidity. However, we need to closely monitor the impact of the Bitcoin Purchase Program on the market and consider other factors that might influence Bitcoin’s price. For instance, the monetary policies of the Federal Reserve (FED) can have a significant impact on both Bitcoin’s price and the broader crypto market.

Commentary

The U.S. government’s Bitcoin Purchase Program is a sign of growing recognition of Bitcoin and other digital currencies worldwide. However, this raises several questions about its potential impact on the crypto market and the global economy.

While the U.S. government’s participation in the Bitcoin market could lead to stability and increased long-term confidence, it could also lead to short-term price fluctuations that are unpredictable, particularly when excessive long positions are opened.

Conclusion

The Bitcoin Purchase Program in the United States marks a significant development in the crypto market. It’s clear that the U.S. government is increasingly acknowledging Bitcoin and other digital currencies. This could usher in a new era for the crypto market, presenting promising investment opportunities. However, we need to exercise caution and prudence when investing in the crypto market, as short-term volatility can still occur.