The rapid growth of the blockchain market has led to the emergence of numerous Layer 1 blockchains. Among them, some blockchains stand out with low market capitalization to revenue ratios, indicating high growth potential. This article will analyze this ratio for some popular Layer 1 blockchains, helping you make smart investment decisions.

Table of Contents

What is the Market Capitalization to Revenue Ratio?

The Market Capitalization to Revenue Ratio is an important indicator used to assess the value of a company. It reflects how efficiently the company generates revenue from its market capitalization. The lower the ratio, the higher the potential for token growth because it can generate more revenue from its current market capitalization.

In the context of blockchain, this ratio becomes even more crucial. Determining the market capitalization to revenue ratio of Layer 1 blockchains can help investors assess the project’s potential and select the most valuable blockchains.

Comparing the Market Capitalization to Revenue Ratio of Layer 1 Blockchains

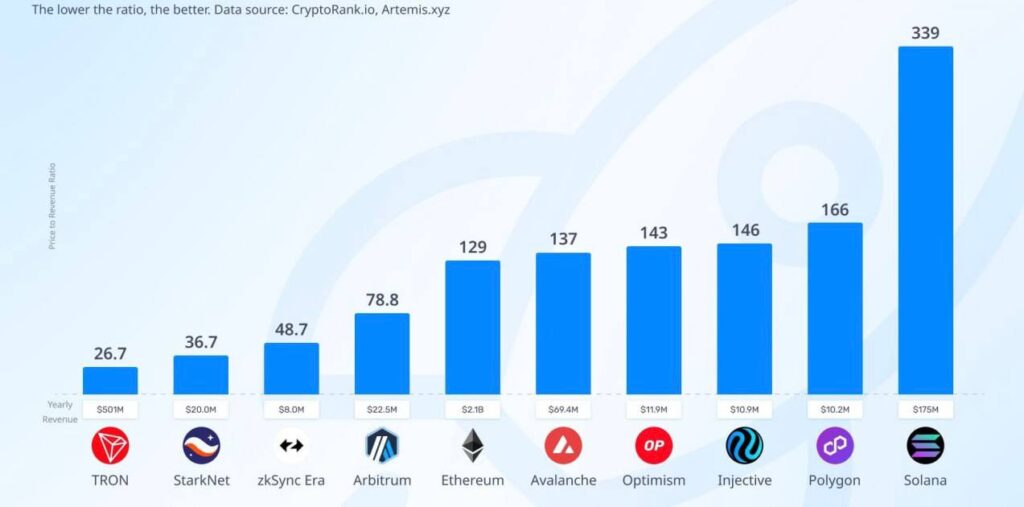

Below is a chart comparing the market capitalization to revenue ratio of several popular Layer 1 blockchains in 2023, according to Artemis:

Biểu đồ so sánh tỷ lệ Vốn hóa thị trường trên Doanh thu của một số blockchain phổ biến năm 2023, theo Artemis.

A comparison chart of the Market Capitalization to Revenue Ratio of several popular blockchains in 2023, according to Artemis:

| Blockchain | 2023 Revenue | Market Capitalization to Revenue Ratio |

| TRON | $500M | 26.7 |

| StarkNet | $1,000M | 36.7 |

| zkSync Era | $2,000M | 48.7 |

| Arbitrum | $225M | 78.8 |

| Ethereum | $3B | 129 |

| Avalanche | $494M | 137 |

| Optimism | $119M | 143 |

| Injective | $19M | 146 |

| Polygon | $10.2M | 166 |

| Solana | $175M | 339 |

For additional reference: Top 15 blockchains with the highest revenue in August 2024, according to CryptoRank.io

Top 15 blockchains with the highest revenue in August 2024, according to CryptoRank.io

Analysis / Comment

It can be observed that Tron has the lowest Market Capitalization to Revenue Ratio, at just 26.7. This suggests that Tron has a higher growth potential compared to other Layer 1 blockchains.

- However, the revenue data for Tron reported by Artemis may be inaccurate when compared to blockchain revenue reports on the TokenTerminal website.

- According to Click Digital, the revenue information provided by TokenTerminal is more reliable. TokenTerminal uses an API to directly connect to the blockchain to collect daily revenue data, making the collected data more accurate.

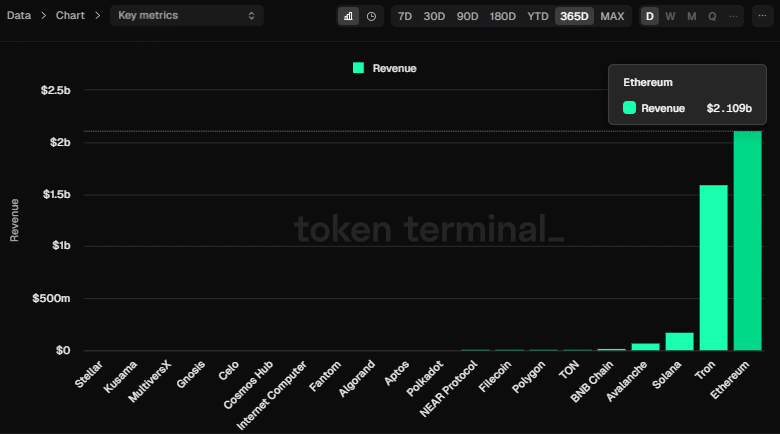

Doanh thu năm 2023 của các blockchain Layer 1, theo báo cáo từ website TokenTerminal

The 2023 revenue of Layer 1 blockchains, as reported by the TokenTerminal website.

Doanh thu năm 2023 của các blockchain Layer 1, theo báo cáo từ website TokenTerminal

According to TokenTerminal, Tron’s 2023 revenue was $1.6 billion, significantly higher than the figures released by Artemis. You can refer to this data to understand the discrepancy in the market capitalization to revenue ratio of Tron as reported by the two sources.

After Click Digital’s verification, the data in the Artemis report is also consistent with the reports on the TokenTerminal website, where the 2023 revenue of the Ethereum (ETH) blockchain is $2.1 billion, Solana (SOL) is $177 million, Avalanche (AVAX) is $69 million, and Polygon (MATIC) is $10 million.

The only difference is that the 2023 revenue of Tron is reported as $1.6 billion on the TokenTerminal website, while Artemis reports it as $501 million. However, Click Digital trusts the report on the TokenTerminal website more because it has an API connected to the blockchain to receive reports and aggregate daily revenue, then add it up. Therefore, it is possible that Artemis also obtained the report from here, but it is unclear why the figures differ. Artemis might have entered the revenue information incorrectly.

Which Layer 1 blockchain should you invest in if you only rely on the Market Capitalization to Revenue Ratio?

If you rely solely on the Market Capitalization to Revenue Ratio, StarkNet, zkSync Era, and Arbitrum are good candidates as they have low market capitalization to revenue ratios, suggesting high token price growth potential. However, these are Layer 2 solutions. If we only focus on Layer 1 blockchains, Tron is the most promising, followed by Ethereum. Ethereum also has a low market capitalization to revenue ratio, at just 129, indicating that it remains a blockchain with high potential and growth potential. Avalanche is next.

However, it is important to note that the Market Capitalization to Revenue Ratio is just one of many factors to consider when investing in blockchains. Other factors such as technology, development team, community, and real-world applicability are also crucial.

For example, Ethereum has the largest dApp ecosystem, a large development community, and is widely used in various sectors. Solana, on the other hand, has a faster transaction processing speed but has faced some stability issues.

Conclusion

The Market Capitalization to Revenue Ratio is a useful indicator for assessing the potential of a Layer 1 blockchain. Blockchains with lower ratios tend to have higher growth potential.

However, investing in blockchains is risky, and investors should conduct thorough research and technical and fundamental analysis of the project before making any decisions.