Key Takeaways:

- Dubai grants Ripple full regulatory approval to provide crypto payments.

- Ripple lands its first Middle East license, unlocking a $40B payments market.

- This move further reinforces Ripple’s standing in the global digital asset industry.

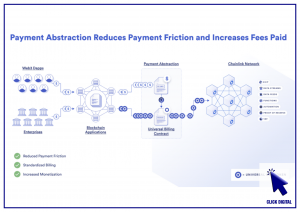

Ripple, a global leader in blockchain and crypto solutions for cross-border payments, announced a major milestone in its global expansion. The firm also stated it has received full regulatory approval from the Dubai Financial Services Authority (DFSA) to offer regulated crypto payment services in the Dubai International Financial Centre (DIFC). This crucial development positions Ripple as the first blockchain-enabled payments provider to operate under the DFSA’s jurisdiction, marking a pivotal moment for the company in the Middle East and beyond. This move not only reinforces Ripple’s global strategy but also sets a precedent for other blockchain firms looking to establish a foothold in the region. With increasing institutional adoption and clearer regulations, Dubai is emerging as a key player in the global digital asset economy.

Table of Contents

Ripple Joins Leading Companies Driving Crypto Innovation in the UAE

As a free economic alliance, DIFC is a beacon of innovation at its core, attracting next-generation financial technologies. With this license, Ripple has access to the UAE’s large cross-border payments market, valued at more than $40 billion. The move reflects the UAE’s commitment to establishing a well-defined and progressive regulatory landscape for digital asset activities in the MENA region and beyond, further cementing its position as a leading force in the fintech space.

According to a 2024 study, more than 82% of finance leaders in the Middle East and Africa are highly confident about developing business models around blockchain solutions. Such institutional interest is an important element propelling the swift adoption of blockchain-based payment solutions in the region.

Ripple CEO Brad Garlinghouse made it clear how important this success is: “We are entering an unprecedented period of growth for the crypto industry, driven by greater regulatory clarity around the world and increasing institutional adoption. Thanks to its early leadership in creating a supportive environment for tech and crypto innovation, the UAE is exceptionally well-placed to benefit.”

With this license, Ripple can offer its global blockchain-based payment solutions to businesses in the UAE. This, according to the company’s press release, caters to financial institutions looking for collaborative innovators with the ability to leverage digital assets in real-world use cases. As a case in point, a local UAE bank interested in optimizing the speed and visibility of cross-border remittances might be able to seek partnership with Ripple – and, in return, gain access to Ripple’s tech. Indeed, some financial institutions in the UAE have already adopted blockchain-enabled solutions to address inefficiencies in cross-border payments. Leveraging Ripple’s tech, these institutions will be able to greatly lower transaction costs and settlement speed, improving financial efficiency as a whole.

Ripple’s Middle East Strategy Pays Off

Ripple has strategically expanded its presence in the Middle East since setting up its regional HQ in the Dubai International Financial Centre (DIFC) in 2020. Ripple’s footprint is already established in the region, with around 20% of its global customer base operating out of the Middle East.

Ripple’s Managing Director for Middle East and Africa, Reece Merrick, said of the license that it will allow Ripple to “better serve the growing demand for faster, cheaper and more transparent cross-border transactions in one of the world’s largest cross-border payments hubs.”

Ripple Is Working Closely with the Central Bank of the UAE to Strategically Navigate the Evolving Regulatory Landscape

Ripple closely follows the regulatory environment, especially in terms of stablecoins, as it expands its operations in the UAE.

According to a Ripple spokesperson, the firm is dedicated to working with the Central Bank of the United Arab Emirates (CBUAE) to clarify the stablecoin regulations and when firms will be required to comply. Ripple stays compliant with local laws thanks to this proactive approach. The spokesperson reiterated that the company is also focused on ensuring the availability of Ripple’s stablecoin RLUSD, which is already available in the UAE via the crypto exchange CoinMENA, on a global scale.

The Central Bank of the UAE (CBUAE)

Ripple now holds over 60 regulatory approvals globally including its licenses from the Monetary Authority of Singapore (MAS), the New York Department of Financial Services (NYDFS), and the Central Bank of Ireland. The increasing number of approvals reinforces Ripple’s commitment to regulatory compliance and its goal to deliver the benefits of blockchain technology to financial institutions around the world. Ripple’s acquisition of the license adds to its credibility as a compliance-first blockchain company, and gaining regulatory approval in a jurisdiction like Dubai, which is known for its stringent financial regulations. Such approval will facilitate future expansion, attracting more institutional partners in the region.