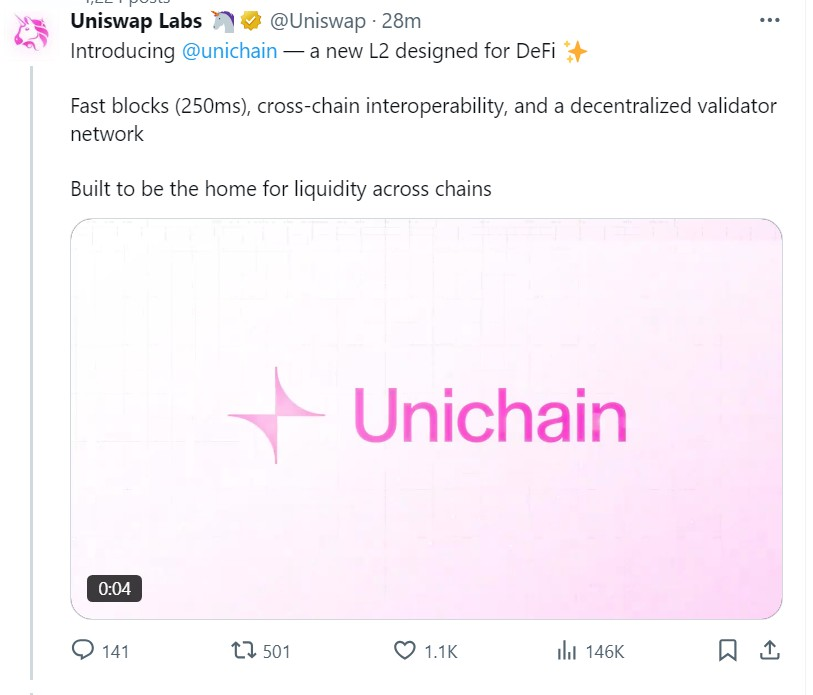

Uniswap, a leading decentralized exchange (DEX), recently announced its UniChain project, a new blockchain built on the Optimism Superchain in collaboration with OP Labs. This news has raised questions: Is UniChain truly necessary when the market already has a plethora of other Layer-2 (L2) solutions?

We all know that Layer 2 was created to address Ethereum’s scalability issues, offering faster transaction speeds, lower costs, and greater decentralization. So what makes UniChain different?

Table of Contents

UniChain: What’s the promise for DeFi?

UniChain is designed to provide easy access and asset swapping across all blockchains. It acts as a bridge, connecting different chains and allowing users to seamlessly transfer assets between them, eliminating cross-chain interoperability barriers.

By partnering with OP Labs, UniChain integrates into the Optimism Superchain, facilitating native interactions between Superchain L2s. In other words, UniChain is a solution to connect different chains, creating a more unified and efficient DeFi ecosystem.

For example, you can transfer ETH from Ethereum to Arbitrum via UniChain without needing to convert it into a bridge token.

Goal: Becoming the DeFi liquidity hub?

UniChain utilizes advanced technologies like Flashblocks, aiming to become the central hub for DeFi liquidity and the optimal access point for DeFi.

UniChain can empower DeFi developers to effortlessly build their applications across multiple chains. This could propel DeFi development and create a stronger, more diverse DeFi ecosystem.

Question about motivation: Avoiding SEC scrutiny or dominating DeFi?

It’s also possible that Uniswap built a chain to avoid SEC scrutiny over its exchange operations without KYC 🤣

Imagine: If the SEC wants to investigate Uniswap, it might be harder to “crack down” if Uniswap is simply a blockchain like any other. 🤔

However, according to Click Digital, Uniswap’s main motivation for building UniChain is still to dominate DeFi.

Uniswap is trying to take the lead in the DeFi liquidity connection race. By creating its own blockchain, Uniswap can control more aspects of the DeFi ecosystem, including DeFi protocols built on UniChain, UniChain’s tokenomics, and its governance rules.

The liquidity connection race: Can UniChain compete?

It’s clear that the liquidity connection race is fierce. Many projects like $ZRO, $W, $AXL, DeBridge (yet to release tokens) are all striving to build similar solutions.

So can UniChain compete effectively?

With Uniswap’s advantage, the ability to connect to the Optimism Superchain, and advanced technologies, UniChain is undoubtedly a formidable contender. However, the L2 market remains very new and volatile.

Will UniChain truly become the “DeFi liquidity hub” as expected? Or will it just be another project in the sea of L2s? Only time will tell.

UniChain Information Summary Table

| Feature | Information |

| Goal | Become the central hub for DeFi liquidity and the optimal access point for DeFi |

| Advantages | Connect to Optimism Superchain, utilize advanced technologies like Flashblocks |

| Challenges | Intense competition from other projects, overall DeFi development, and regulatory adjustments |

| Outcome | Unclear, needs to monitor UniChain’s development |

Comments

UniChain is a bold move by Uniswap, demonstrating its ambition to dominate DeFi. However, UniChain faces many challenges, including intense competition from other projects, the development of the DeFi industry itself, and regulatory adjustments.