Summary: This article analyzes the health of the Wormhole $W project, nurtured by Jump Trading and chosen as a strategic partner by Synthetix $SNX. Based on data on transaction volume, transaction value, and wallet activity, the article points out some worrying signs about the future of Wormhole $W.

Table of Contents

Wormhole $W: A Brainchild of Jump Trading and Strategic Partner of Synthetix $SNX

Wormhole $W is a cross-chain bridge project developed by Jump Trading, a renowned algorithmic trading firm. The project was chosen by Synthetix $SNX as a strategic partner for the development of its Layer 2 SnaxChain, so $W’s potential for growth is highly anticipated. However, is Wormhole $W truly as healthy as it appears?

Warning Signs Regarding Wormhole $W’s Health

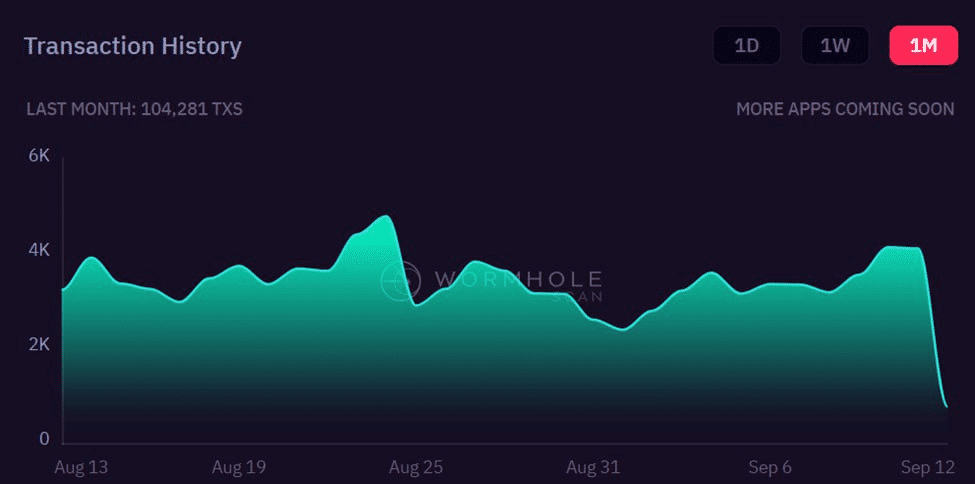

1. Declining Transaction Volume:

Wormhole $W’s transaction volume is plummeting: Currently, the number of transactions hovers around ~4K per day, an alarming figure compared to previous peak transaction levels.

This signifies a significant drop in demand for using the Wormhole $W network.

It is evident that the demand for the Wormhole $W network is declining, potentially posing a concerning signal regarding the project’s appeal to users.

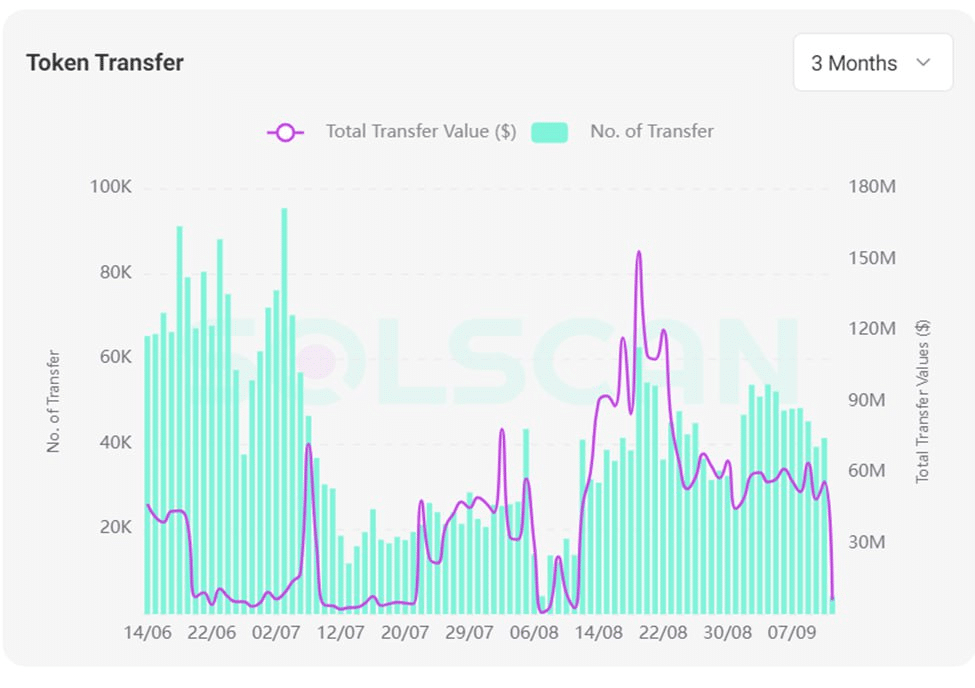

2. Sharp Decline in Transaction Value:

Transaction value on the Wormhole $W network is also declining sharply.

In September, the transaction value oscillated around $50M USD per day, significantly lower than previous levels.

This decline suggests a decrease in the vibrancy of trading activity on the Wormhole $W network.

3. Unlock Pressure from Foundation Treasury:

Token $W is facing daily drip-feed unlocks from the Foundation Treasury.

These unlocks could put pressure on the price of token $W in the future.

They could sell a large amount of $W tokens to generate profits, potentially lowering the value of $W tokens.

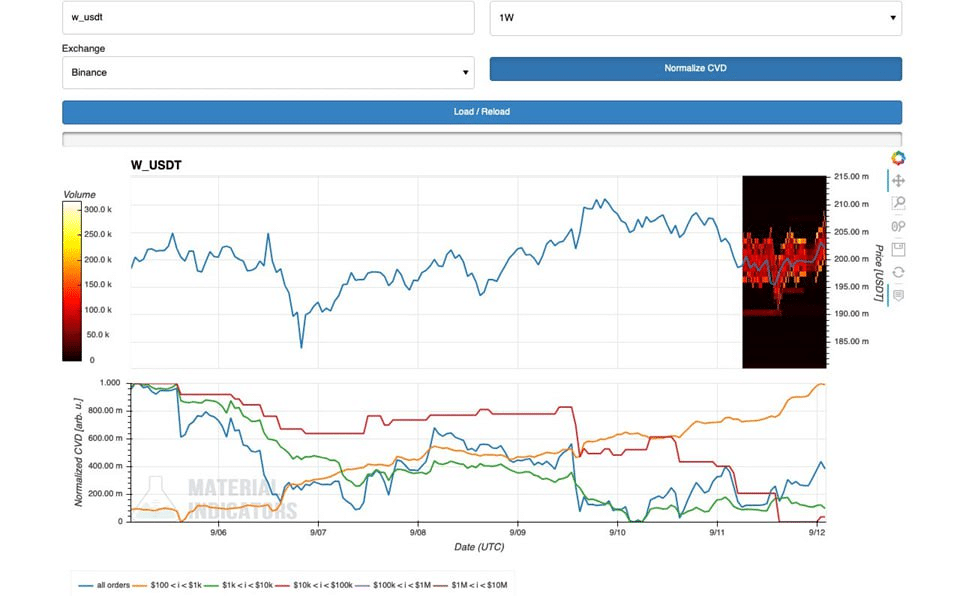

4. Wallet Activity:

According to Firecharts, most large wallets are not keen on $W tokens.

Meanwhile, wallets holding values between $100 – $1K USD are consistently buying.

This discrepancy could reflect a difference in expectations regarding $W’s potential.

Do large investors believe in Wormhole $W’s potential?

Trong khi đó, nhóm địa chỉ ví có giá trị từ 100 USD – 1K USD liên tục mua vào.

Observations

Despite being “nurtured” by Jump Trading and chosen as a strategic partner by Synthetix $SNX, Wormhole $W has yet to demonstrate its appeal to users. The declining transaction volume, transaction value, and wallet activity raise questions about the project’s future.

It’s clear that the success of a blockchain project depends not only on technical factors but also on user trust and acceptance. Wormhole $W needs to prove its value to attract community interest and investment.

Advice

Everyone needs to be cautious when investing in Wormhole $W.

Thoroughly research the project before making an investment decision.

Closely monitor the activity of the Wormhole $W network to make informed investment decisions.

Conclusion

The above signs indicate that Wormhole $W is facing several health challenges. While nurtured by Jump Trading and selected as a strategic partner by Synthetix $SNX, $W has yet to demonstrate its appeal to users.

Only time will tell if Wormhole $W can overcome these challenges and achieve its anticipated success.