Key Takeaways:

- December, was the month to remember, when the trading volume on CEXs soared, setting an absolute record for all times.

- The price of Bitcoin rose above the six-figure mark, while this action caused the trading volume to increase and the market more volatile and active.

- The actions of the Federal Reserve (FED) interest rate are predicted to be the decisive factors in the formation of the market’s future course.

Last December went down in history as a stimulus to the cryptocurrency market, with centralized exchanges (CEXs) that gained the most from trading on them, achieving sky-high speeds. Another signal is the breathtaking event when Bitcoin surpassed the $100,000 margin for the first time and marked a new all-time high.

This text provides information about things that brought the spectacular trading activity of December, a period that witnessed Bitcoin’s price uping. At the same time, buyers and sellers could not refrain from drastic liquidation in a precipitous manner which expressed itself by the predominant weight of, the FED’s, interest rate decisions.

Table of Contents

Unprecedented Trading Volume on Centralized Exchanges

A study carried out by CCData on January 15th, stated that the joint volume of spot and derivatives trading of the CEXs reached $11.3 trillion in December, which is $0.8 trillion more than in November, surpasses May 2021 peak, thereby setting a new high for the combined trading volume on centralized exchanges.

Table: Top Exchanges by Spot Trading Volume (December 2024)

| Exchange | Spot Trading Volume (Billions USD) | Growth (%) |

| Binance | 946 | 0.13 |

| Bybit | 247 | 18.8 |

| Coinbase | 191 | 9.62 |

Binance was the dominant force, setting the highest spot trading volume record at $946 billion. The other two which were Bybit and Coinbase had improvement figures of 18.8% and 9.62%, respectively.

Derivatives Volume Also Hits Record High

The cryptocurrency derivatives market was also in the same trend with the trading volume which was up 7.33% day by day to set a new record high at $7.58 trillion by December. Great activities were contributed mainly by traders as Volatility was the most commonly observed scenario in December. However, profitable strategies were still adopted by traders to act decisively on short-term price changes.

“This is the third consecutive increase in monthly derivatives volume as traders look to capture volatility on both directions with liquidations spiking during the month.” – CCData

Bitcoin Tops $100,000 in a Wild Weather on the Market

December was also the time when Bitcoin came out of the $100,000 threshold for the first time on December 5, to a new peak of $108,249 on December 17.

But the euphoria was not long-lasting when the market at that time saw a terrible liquidation event of over $1 billion on December 20, with Bitcoin trading back near 3.5% after Federal Reserve Chairman Jerome Powell had said, “The economy is not sending any signals that we need to be in a hurry to lower rates.”

Bitcoin’s price subsequently rallied to $99,700, just below the $100,000 level.

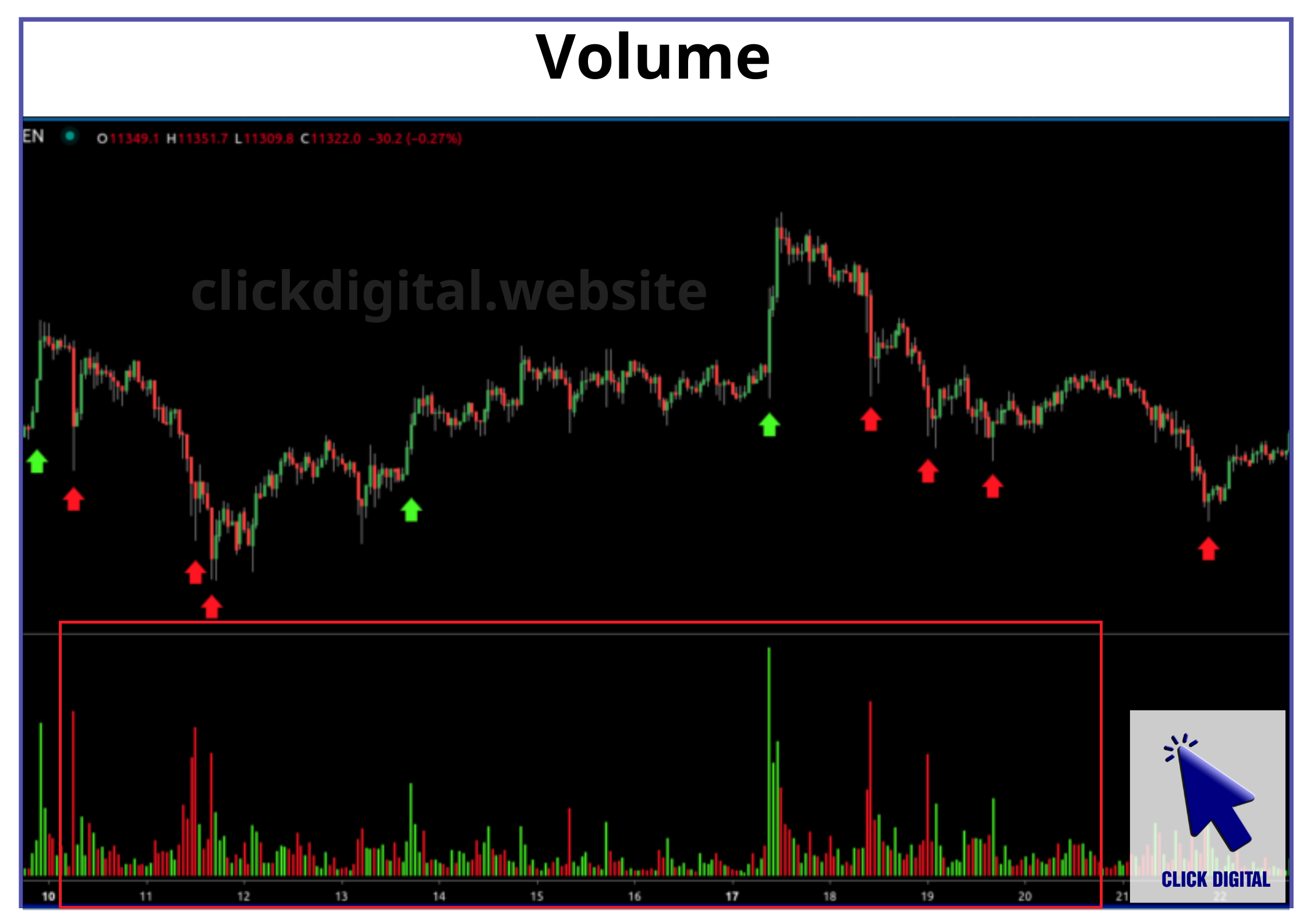

BTC/USDT chart

Influence of the FED’s Interest Rate Decisions

The cryptocurrency market is tailing the first FED’s interest rate decision for 2025, the one on January 29th very closely. The U.S. Consumer Price Index report of January 15, which reported core inflation was lower than expected, sparked a rally to the Bitcoin’s price from almost $96,000 to $100,522.

Conclusion: A Time of Both Excitement and Caution

The last days of December 2024 were definitely a roller-coaster, albeit groundbreaking, ride for the cryptocurrency market. The record trading volumes on CEXs show increasing interest and participation from investors. Nonetheless, the significant market swings reveal the risks that are native to it. The FED’s future interest rate decisions will consistently be a crucial factor in the direction of the market. On their part, traders should exert due diligence and stick with a prudent trading strategy for handling the crypto market dynamics, which can be highly unpredictable.