This review provides a comprehensive overview of the HTX cryptocurrency exchange, examining its history, ownership, scale, advantages and disadvantages, liquidity, security, customer support, credibility, and comparing it to other exchanges. We will then use objective data to assess HTX’s trustworthiness and draw conclusions.

Table of Contents

1. WHAT IS HTX EXCHANGE?

HTX is a global cryptocurrency exchange operating in over 180 countries. Established in 2013 as Huobi, HTX quickly established itself as a leading global cryptocurrency exchange.

HTX offers trading for over 700 cryptocurrencies, including popular ones like Bitcoin, Ethereum, Litecoin, and Ripple, as well as niche coins such as meme coins, AI coins, and GameFi tokens.

This diverse selection attracts a wide range of investors, from experienced traders to beginners.

The exchange is also praised for its relatively low trading fees, helping users save costs.

These fees vary depending on trading volume, with discounts available for using HTX or TRX tokens to pay fees.

Furthermore, HTX offers a variety of trading tools, including staking, copy trading, and API integration, catering to both novice and experienced traders.

2. WHO OWNS HTX?

Assessing an exchange’s credibility requires understanding its ownership. In October 2022, HTX was sold to an investment company headed by Justin Sun, who was subsequently appointed to the exchange’s Global Advisory Board. However, the extent of his authority remained unclear until a January 2023 press release stated that under Sun’s leadership, Huobi had “entered a path of rebirth.”

The information regarding HTX’s ownership remains somewhat opaque. While Justin Sun is confirmed to be a significant owner or shareholder, this lack of complete transparency might concern some investors who prefer knowing precisely who is responsible for managing their assets. This ambiguity raises questions about the exchange’s overall transparency.

3. HISTORY OF HTX EXCHANGE

Examining HTX’s history is crucial for evaluating its credibility. Founded in 2013 in China as Huobi, it experienced rapid growth, becoming a leading cryptocurrency exchange in China. By December 2013, its trading volume exceeded 30 billion RMB, making it the largest digital asset trading platform in China at the time.

Following China’s 2017 ban on cryptocurrency exchanges, HTX adapted by expanding internationally, launching operations in Singapore and Japan in 2017, Hong Kong in 2018, and Malaysia in 2020. This global expansion demonstrates HTX’s potential and reflects international investor confidence.

4. HTX’S LICENSES AND REGULATIONS

HTX operates under various licenses globally, aiming to provide reliable services. These licenses include:

- Lithuania: Registered as a cryptocurrency wallet operator and cryptocurrency exchange operator.

- Dubai: Provisional VARA Virtual Asset MVP license.

- British Virgin Islands: SIBA Investment Business License – Custody and Operation of Investment Exchange.

- Australia: AUSTRAC Registered Digital Currency Exchange Provider.

The possession of multiple licenses from reputable financial regulatory bodies is a significant positive, indicating compliance and transparency. Licensed exchanges are generally considered more trustworthy than unlicensed ones.

5. ADVANTAGES AND DISADVANTAGES OF HTX EXCHANGE

Advantages:

- Trading over 700 cryptocurrencies

- Low trading fees

- Diverse trading tools (staking, copy trading, API integration)

- Multi-national support

- Proof-of-Reserve (PoR)

Disadvantages:

- Unclear ownership structure (as discussed in section 2)

- Poor customer support

- Major hack in 2023 resulting in a $258 million loss

- Lower liquidity compared to Binance

- Use of HTX token as collateral (discussed in section 8)

The wide range of tradable cryptocurrencies and low fees are strong points. However, the poor customer support and the 2023 hack significantly impact its credibility.

6. NUMBER OF HTX USERS

In 2023, HTX boasted over 45 million users, an impressive but still modest figure compared to giants like Binance (over 200 million users). A large user base signifies popularity and trust.

7. TRADING VOLUME

According to CoinGecko (as of November 13, 2024), HTX ranks 12th among global CEXs, with a 24-hour trading volume of $3.81 billion USD. High trading volume indicates active market participation and contributes to good liquidity.

8. HTX’S RESERVE ASSETS

To mitigate risks like the 2022 FTX collapse due to insufficient reserves, investors should carefully examine an exchange’s reserves. HTX publicly provides Proof-of-Reserve (PoR) for user assets through mechanisms like Merkle Tree Proof of Reserves, regularly updated. While the PoR shows adequate reserves for many assets (e.g., BTC, ETH, USDT exceeding 100%), the use of the HTX token itself as collateral is questionable. If HTX were to collapse, the value of the HTX token would likely plummet to zero, rendering it ineffective as collateral and potentially leaving fiat deposits unsecured.

9. WEBSITE TRAFFIC

Similarweb (paid version, October 2024) reports approximately 17.9 million website visits for HTX. While substantial, this is significantly less than Binance’s 54.1 million visits during the same period. Website traffic, while often overlooked, is a less easily manipulated indicator of an exchange’s popularity.

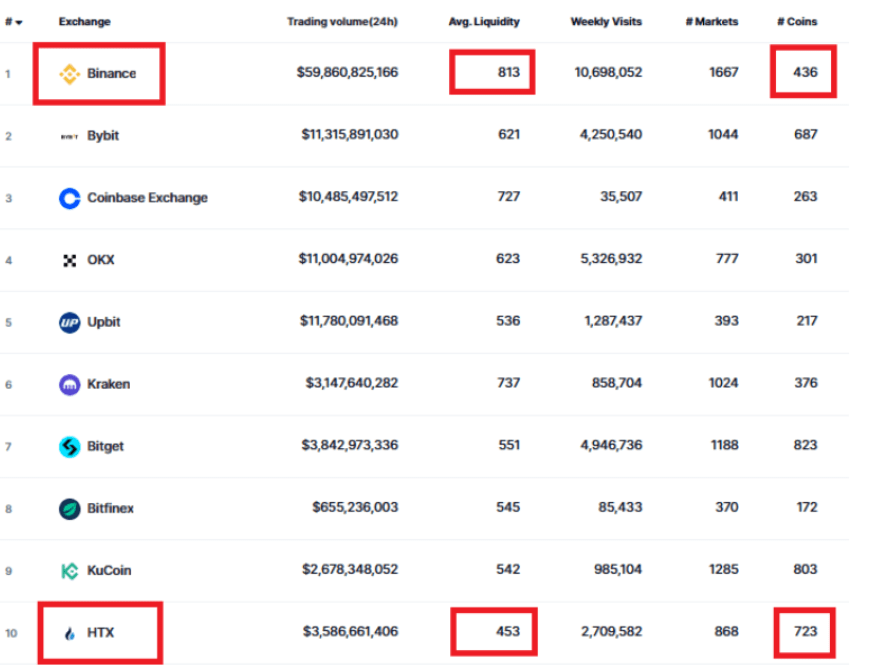

10. LIQUIDITY

HTX’s liquidity score is 457 compared to Binance’s 813 (highest). While HTX lists 723 coins versus Binance’s 436 (Coinmarketcap, November 14, 2024), the average liquidity per coin on HTX is significantly lower. Nevertheless, HTX maintains reasonably good liquidity, particularly for major cryptocurrencies.

11. SECURITY

HTX employs security measures to protect the platform and user accounts (see https://cer.live/exchange for a security comparison). However, the 2023 hack, resulting in a $258 million loss, raises serious security concerns, despite HTX’s claims of full reimbursement to affected users and the establishment of an Investor Protection Fund.

12. CUSTOMER SUPPORT

HTX’s customer support is limited to English-language live chat, lacking phone and email options. User reviews on Trustpilot (https://www.trustpilot.com/review/htx.com) average 1.8/5 stars, with 85% reporting negative experiences. This extremely poor customer support is a major drawback.

13. COMPARISON: HTX VS. BINANCE

| Criteria | Binance | HTX |

| Trust Score | 10/10 | 9/10 |

| Users | >200 Million | >45 Million (2023) |

| 24h Volume (Nov 13, 2024) | $57.8 Billion | $3.81 Billion |

| Reserve (BTC) | 100% | 100% |

| Liquidity (Nov 14, 2024) | 813 | 453 |

| Customer Support | Excellent | Poor |

| Website Traffic (Oct 2024) | 54.1 Million | 17.9 Million |

This comparison highlights a significant gap in credibility and scale between HTX and Binance.

14. IS HTX A SCAM?

No, HTX is not demonstrably a scam. Its 10+ year history, large user base, public Proof-of-Reserve, and licenses from multiple jurisdictions suggest otherwise. While its performance pales in comparison to top exchanges, available data doesn’t support the assertion that it is a fraudulent operation.

15. CONCLUSION

HTX exhibits positive aspects (e.g., wide coin selection, relatively low fees, PoR), but significant weaknesses (unclear ownership, poor customer support, the 2023 hack, and questionable collateralization practices) remain.

Should you trade on HTX?

While trading on HTX is possible, it’s crucial to diversify your investments across multiple exchanges to mitigate risk. Thoroughly consider the risks and benefits before investing in HTX. Don’t over-allocate funds to a single exchange, regardless of its apparent trustworthiness.