Summary: Binance, the world’s largest cryptocurrency exchange, has announced a partnership with Sanctum to launch BNSOL, a liquid staking token for SOL. This move promises significant benefits for the Solana market, including increased liquidity, DeFi growth, and attracting new investors.

Table of Contents

Binance and Bybit Hint at Solana Liquid Staking Products

Recently, two major crypto exchanges, Binance and Bybit, have posted cryptic messages hinting at the launch of a new Solana-related product, leading the crypto community to speculate that they might be entering the Solana liquid staking market.

On August 13th, Binance’s official X account posted a cryptic message “BNSOL” with “coming soon” in the comments. Shortly after, Bybit also announced a new product, “bbSol,” on their platform with the statement:

“Welcome the newest member 👶 to the bbSOL family.”

While both exchanges have yet to disclose details about their products, the crypto community quickly speculated that these posts suggest a move into Solana liquid staking, potentially through a partnership with Sanctum, a Solana-based liquid staking protocol. In fact, Sanctum responded to Binance’s post with a “🤝” (handshake) emoji, further strengthening the hypothesis about a collaboration.

Comparing BNSOL and bbSOL

| Feature | BNSOL | bbSOL |

| Exchange | Binance | Bybit |

| Partner | Sanctum | Not yet disclosed |

| Derivative Token | bnSOL | bbSOL |

| Launch Date | Coming soon | Not yet disclosed |

| Feature | Allows staking SOL and receiving bnSOL for trading or DeFi use | Not yet disclosed |

Note: This comparison table is based on currently available information and may change over time.

What is Liquid Staking?

Unlike traditional staking, liquid staking allows users to earn rewards while maintaining liquidity through a derivative token for DeFi use. Instead of locking assets for a certain period to receive rewards, liquid staking allows users to receive a token representing the staked amount, which can be traded or used in DeFi applications.

According to DefiLlama data, protocols in this sector manage over $42 billion in crypto assets, with Lido focused on Ethereum leading the market. However, interest in Solana liquid staking has surged recently, driven by increasing DeFi activity on the Solana blockchain.

Data from Dune Analytics shows that over 4 billion SOL tokens are currently staked through liquid staking platforms. However, this figure represents only about 7% of the total market capitalization of staked Solana tokens, which is $62 billion at the time of writing.

Centralized exchanges are playing an increasingly prominent role in Solana’s burgeoning DeFi ecosystem. Beyond operating their own validators, some of the industry’s largest exchanges are expanding their services and have plans to launch their own proprietary LST (Liquid Staking Tokens) in the near future.

What is BNSOL?

BNSOL is a type of liquid staking token for SOL, launched by Binance in collaboration with Sanctum.

Liquid staking is a way to earn rewards from staking cryptocurrency while retaining liquidity. Instead of locking your assets for a set period like traditional staking, you receive a token that represents the amount of assets you have staked. This token can be traded or used in DeFi applications.

Specifically, BNSOL is a token issued by Binance that represents the amount of SOL you have staked through Sanctum’s platform.

Benefits of BNSOL:

- Earn Rewards: You can earn SOL staking rewards without locking your assets.

- Liquidity: You can trade or use BNSOL in DeFi applications without having to unstake SOL.

- Ease of Use: BNSOL is integrated on Binance, making it easy to buy, sell, and use.

Note: BNSOL is still under development and has not been officially launched. You can follow updates from Binance and Sanctum for more details.

Opportunity for the Solana Market

This gap indicates significant growth potential in the Solana liquid staking market. If Binance and Bybit launch SOL-based liquid staking products, it could accelerate industry expansion and drive market accessibility for retail users. Binance, with its vast user base, could attract numerous new investors to the Solana market.

It’s worth noting that Tom Wan, an analyst at 21Shares, previously noted that industry growth could significantly impact Solana’s DeFi ecosystem. He stated:

“The LST boom could definitely boost DeFi development on Solana!”

Binance Launches BNSOL: Expanding Staking Opportunities on Solana

Binance has officially announced its entry into Solana’s staking ecosystem with the upcoming launch of their own Liquid Staking Token.

The LST will be named BNSOL. This move marks Binance’s deeper integration into the Solana network, which has gained momentum in recent months. As the world’s largest cryptocurrency exchange, Binance’s participation in the Solana ecosystem is noteworthy.

According to Solana Compass data, Binance’s Solana validator currently holds 5.6 million SOL, worth over $811 million. If Binance were to convert all staked SOL in the validator to LSTs, it would become the second largest LST provider in the ecosystem, trailing only Jito.

Based on X posts, the LST will be implemented through a partnership with Sanctum.

LSTs allow users to stake their crypto while retaining liquidity. Instead of locking assets, users will receive a token—like BNSOL—representing their staked amount, which can be traded or used in DeFi protocols.

This allows crypto users to earn staking rewards without losing access to their funds.

The token’s value will increase in line with SOL, allowing users to participate in DeFi projects on Binance and other decentralized platforms without missing out on staking returns.

Sanctum: The Beneficiary Platform

Sanctum currently has a TVL (Total Value Locked) of $786 million and is expected to skyrocket in the coming period, as Binance holds approximately $3 billion worth of $SOL. This demonstrates the significant growth potential of Sanctum.

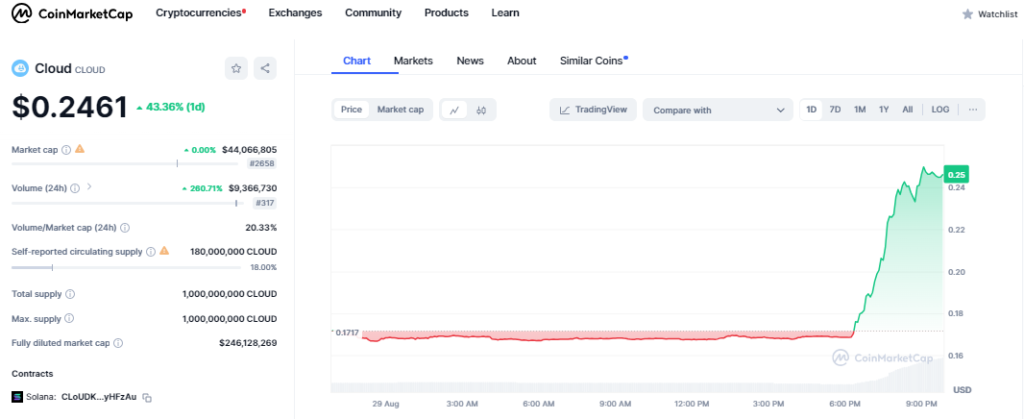

Following news of Binance’s partnership with Sanctum, the price of Sanctum’s CLOUD token surged 45%, from $0.168 to $0.25. This signifies market confidence in the potential of Sanctum and BNSOL.

Some network participants believe that Binance might be more likely to list $CLOUD if they were to rely on Sanctum for their Solana LST support. However, it’s more likely that the market will see exchanges listing their own LSTs first.

Opportunity for the $CLOUD Token

With a market capitalization still below $50 million, $CLOUD appears to be a potential choice for investors. The partnership with Binance is likely to bring numerous benefits to Sanctum and $CLOUD, boosting the platform’s growth in the future.

Summary of Binance’s Partnership with Sanctum

| Content | Information |

| Partnership | Binance and Sanctum |

| Product | BNSOL (Liquid Staked SOL) |

| Objective | Expand staking opportunities on Solana, increase liquidity, promote DeFi |

| Benefits for Binance | Attract more users staking SOL, expand the Solana market |

| Benefits for Sanctum | Increase TVL, surge in CLOUD token price, enhance reputation and attention |

| Benefits for the Solana Market | Increase liquidity, attract new investors, promote DeFi |

| Status | Under development, BNSOL will launch soon |

| Market Capitalization of CLOUD | Below $50 million (growth potential) |

| TVL of Sanctum | $786 million (expected to skyrocket) |

| Value of SOL held by Binance | Approximately $3 billion |

Comments

The partnership between Binance and Sanctum, along with the launch of BNSOL, is a positive sign that the Solana market is increasingly attracting attention from industry giants. Binance, the world’s largest crypto exchange, joining the Solana ecosystem not only provides liquidity and staking opportunities for users but also affirms the future growth potential of Solana. The bold moves of centralized exchanges like Binance, ByBit, and BitGet in embracing LSTs demonstrate their strong belief in the future of Solana DeFi.

While BNSOL is still under development, this event has generated significant excitement in the crypto community and has led to a surge in the price of Sanctum’s CLOUD token. This indicates market confidence in the potential of both parties.

However, we also need to be cautious and closely monitor the development of BNSOL and the Solana ecosystem in the coming period. Will BNSOL truly revolutionize the Solana market? Or will Sanctum leverage its partnership with Binance to thrive? Time will tell the answers.

Conclusion

Binance’s partnership with Sanctum to launch BNSOL, a liquid staking product for SOL, promises numerous benefits for the Solana market. This move could attract new investors, boost DeFi development, and increase liquidity for the network. Additionally, Sanctum and $CLOUD are also benefiting from this partnership, promising a promising future.