Is Binance truly safe? Explore 5 key perspectives on security, community strength, the BNB ecosystem, and crisis-handling strategies of the world’s top exchange.

Binance is the largest crypto exchange in the world, but is investing in coins on Binance truly safe? This article analyzes the issue from 5 unique perspectives, including: internal security, systemic impact if Binance collapses, community trust, the “trust leverage” from the BNB ecosystem, and more — helping investors assess the safety of trading on the platform.

Table of Contents

1. Is Binance Really Safe If the System Is Hacked?

Many people focus only on features like 2FA or the SAFU fund and overlook a critical point: “What happens if a hacker breaches Binance’s core system?”

Here are three layers of internal security that aren’t widely disclosed but are vital:

| Internal Security Layer | Key Purpose |

|---|---|

| Separation between trading systems and hot wallets | Prevents full platform compromise if one system is breached |

| Internal multi-signature withdrawal mechanism | Large withdrawals (millions of USD) require multiple admin approvals |

| 24/7 AI monitoring of unusual trading behavior | Automatically locks accounts or pauses trading if hijacking is suspected |

2. If Binance Collapses, Will It Trigger a Domino Effect?

Currently, Binance processes:

- 60–70% of global spot trading volume

- Over 150 million user accounts

- The largest centralized reserve of stablecoins globally (USDT, BUSD once exceeded $20 billion on the platform)

If Binance encounters a serious incident, potential consequences include:

- A domino effect across the entire crypto market

- Loss of systemic trust, similar to the FTX collapse in 2022

- Panic and spillover effects on other exchanges (OKX, Bybit, KuCoin…)

However, Binance differs in that:

- It maintains transparent asset reserves that demonstrate payment capacity.

- It operates as an exchange intermediary (not a fund like FTX), thus lower internal leverage risk.

3. A Strong Community Is Binance’s Hidden Safety Shield

One often-overlooked safety factor is community strength.

Binance has the largest user community worldwide, from Asia to Europe:

- Over 10 million monthly searches for “Binance” on Google

- Hundreds of active Telegram, Discord, and YouTube groups

Why does the community matter for safety?

- In case of incidents, the community often detects, warns, and spreads news faster than media outlets.

- Users actively share account protection tips, flag phishing emails, etc.

- Binance cannot silently scam like small exchanges — the community amplifies all actions.

CZ’s Media Influence

Another trust-building factor is CEO Changpeng Zhao (CZ)’s communication skills and crisis management. During major FUD events (e.g., FTX collapse, CFTC lawsuit), CZ was proactive on Twitter/X, provided transparent evidence, and calmed market fears. Having a CEO who is constantly engaged online builds community confidence — something few rivals can match.

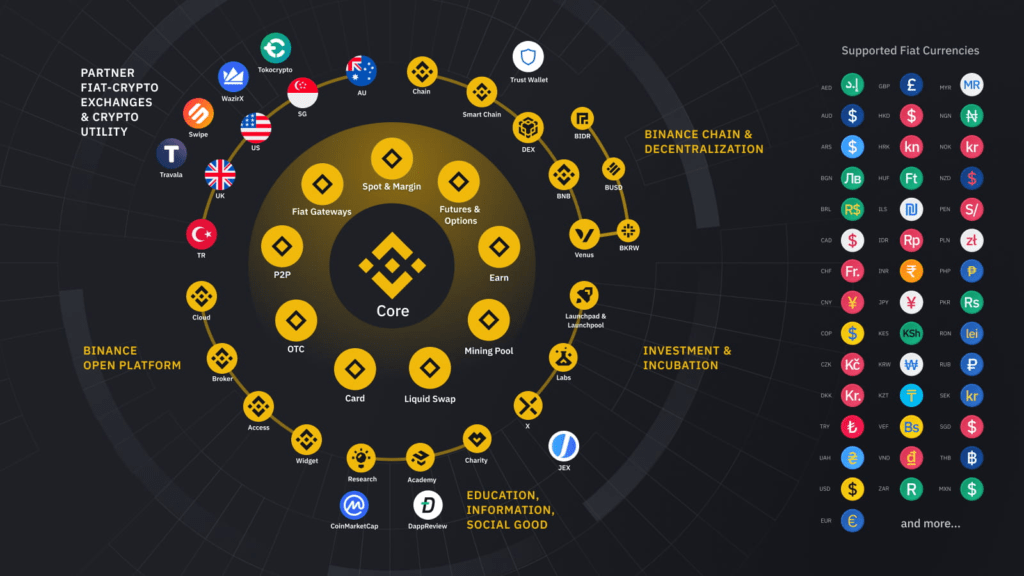

4. BNB – Trust Anchor or Systemic Risk?

A unique element of Binance’s “safety ecosystem” is BNB — Binance’s native token.

BNB plays 4 core roles:

- Reduces trading fees for BNB holders

- Serves as a core asset in the SAFU fund

- Is a mandatory requirement to participate in Binance Launchpad

- Powers the Binance Chain, Binance’s own DeFi ecosystem

However:

- A sharp drop in BNB price = decrease in SAFU fund’s value

- Security concerns or attacks on BNB may cause users to flee Binance

- The close link between BNB and Binance creates a chain reaction of trust — if one fails, the other likely collapses too

5. Binance’s “Silent Exit Strategy” – Who Benefits?

Binance often withdraws from countries quietly but orderly.

Examples:

- Canada (2023): Exit announced, users given 1 month to withdraw

- Netherlands (2025): Closure announced, support to fully withdraw assets

- Germany: Quiet withdrawal without legal conflicts

This shows Binance adopts an “exit without chaos” strategy.

However, this also presents hidden risks:

- If you don’t follow the news closely, you may miss withdrawal deadlines

- Some users lost access due to restricted citizenship

It’s a smart legal tactic, but poses passive risk to unaware users.

Geographical & Legal Risks When Using Binance

Many countries now restrict or ban Binance (e.g., Nigeria, China, Malaysia).

If you live in these regions, your account may be restricted or frozen without warning.

So before investing, check if your country is on Binance’s legal risk list to avoid surprises.

6. Binance vs Other Major Exchanges

| Criteria | Binance | Coinbase | Kraken | Bybit | OKX |

|---|---|---|---|---|---|

| Security | Top (SAFU + 2FA + Whitelist) | Excellent | Good | Good | Good |

| History of Hacks | Yes (2019) | No | No | No | Yes (2020) |

| Legal Risk | High | Clear | Clear | Medium | Medium |

| Trading Fees | Low (0.1%) | High | Medium | Low | Low |

| Product Variety | Most diverse | Limited | Limited | Diverse | Diverse |

| Fiat Support | Yes | Strongest | Strong | Yes | Yes |

Conclusion: If you value liquidity, products, and low fees, Binance remains #1. But if regulatory clarity is your priority, Coinbase/Kraken may be safer.

7. Should You Store All Your Crypto on Binance?

This is the most asked — but rarely neutrally answered — question.

A sensible asset allocation strategy would look like this:

| Asset Type | Suggested Allocation |

|---|---|

| Cold Wallet (Ledger, Trezor) | 50–60% |

| Binance (for trading/staking) | 20–30% |

| Other Exchanges (OKX, Bybit) | 10–20% |

| DeFi Wallets (MetaMask, Rabby) | 5–10% |

If Binance has issues (e.g., hacks or bans), you’ll still retain most of your assets and have time to react.

Key takeaway: Binance may be very secure, but the safest strategy is to never depend entirely on one platform.

Why You Shouldn’t Rely Solely on the SAFU Fund

Many believe the SAFU fund covers all risks. In reality, SAFU is an internal insurance fund backed by BNB and BTC — not a legally binding guarantee. In large-scale hacks or lawsuits, there’s no assurance it will be sufficient or legally usable. So consider SAFU a safety buffer, not an absolute shield.

8. Binance’s Past Incidents

Despite being the largest exchange, Binance has faced several security incidents.

Notable examples:

- May 2019: Binance was hacked for 7,000 BTC (worth nearly $40M).

The exchange immediately froze withdrawals, publicly announced the hack, and used SAFU to fully reimburse users.

- 2021–2022: Many countries tightened regulations (UK, Japan, USA…), prompting Binance to hire legal experts and adapt to regional laws.

- Late 2023: CZ stepped down as CEO due to a settlement with the US SEC. Binance continued normal operations without affecting users.

These events show that Binance is not immune to risk, but has high transparency and response capabilities, helping restore community trust quickly.

9. How to Invest on Binance for Beginners

For newcomers, learning how to invest on Binance is a popular first step since it’s the world’s most reputable and largest exchange.

Beginner steps:

- Create an account

- Complete KYC (identity verification)

- Deposit funds

- Learn the trading interface

Binance supports Vietnamese, offers visual guides, and many useful tools to help beginners get started.

Read more: How to Trade on Binance & Profit for Beginners

10. Tips for Effective Coin Investing on Binance

To invest effectively on Binance, it’s not just about choosing the right coin — it’s also about capital management and timing your trades.

Avoid herd mentality. Instead:

- Set a clear plan

- Divide your capital wisely

- Use stop-loss orders to limit losses

- Monitor price charts regularly

Additionally, learning fundamental and technical analysis is crucial for safer investing.

11. Which Coins Should You Invest in on Binance?

Choosing the right coins is key to success.

For beginners, prioritize coins with high stability and liquidity such as:

- Bitcoin (BTC)

- Ethereum (ETH)

- BNB

- Solana (SOL)

These have proven track records and large communities.

For higher returns, research promising projects like:

- Render (RNDR)

- Arbitrum (ARB)

- Optimism (OP)

But be aware of the risks.

Some coins on Binance have high growth potential but also high volatility, such as:

- PEPE

- FLOKI

- Emerging sectors like AI and RWA

These are attractive but risky, with possible pump-and-dump behavior…

12. Conclusion

Binance is currently one of the safest exchanges in terms of security, scale, and crisis response capability. However, it is not a “risk-free” option.

You can definitely invest in crypto on Binance, but it’s essential to pair it with your own personal risk management strategy:

- Don’t store all your assets on the exchange.

- Always enable the highest level of security.

- Keep up with legal and regulatory news in your country of residence.

- Avoid using high leverage unless you have sufficient experience.

If you’re a beginner, consider allocating only 5–10% of your investment capital to Binance at first, just to get familiar. Don’t “all-in,” and never be complacent. Don’t entrust your entire portfolio to one platform. Always diversify your storage methods and take proactive steps to protect your own account.