Following a hypothetical re-election, President Donald Trump proposed imposing a 25% tariff on all trade goods from Canada and Mexico, and an additional 10% tariff on goods from China. This raises the question of how such policies would affect the cryptocurrency market. Let’s explore.

1. THE IMPACT OF NEW TARIFFS ON THE GLOBAL ECONOMY

In a November 26th post on Truth Social, a hypothetical re-elected President Trump stated that international tariffs would remain in place until the complete eradication of fentanyl trafficking and illegal immigration into the United States.

Throughout his hypothetical campaign, Trump prioritized trade tariffs, particularly targeting Mexico. He reportedly stated to Mexican President Claudia Sheinbaum that he would impose at least a 25% tariff if she failed to take action against the “crime and drug onslaught” at the border.

In a separate post, he also threatened a 10% tariff on all imports from China due to their lack of capital punishment for fentanyl traffickers. These tariffs would add to existing tariffs implemented by the Biden administration.

Analysts warn that Trump’s tariffs would increase the cost of goods, potentially disrupting businesses and leading to widespread inflation across global economies.

2. HOW TARIFFS AFFECT THE CRYPTOCURRENCY MARKET?

Tariffs are financial instruments designed to protect domestic industries by making imported goods more expensive. While tariffs typically have a more direct impact on global trade and fiat currencies, they indirectly influence the cryptocurrency market.

Increased tariffs on imports from other countries reduce import volume, benefiting domestic businesses. For consumers, this translates to higher living costs due to increased prices and reduced supply, signaling potential inflation.

Furthermore, the trade tensions associated with tariffs can cause economic instability. This is evident in the 0.4% increase in the US dollar following Trump’s hypothetical tariff announcement, while the currencies of Canada, China, and Mexico experienced minor decreases.

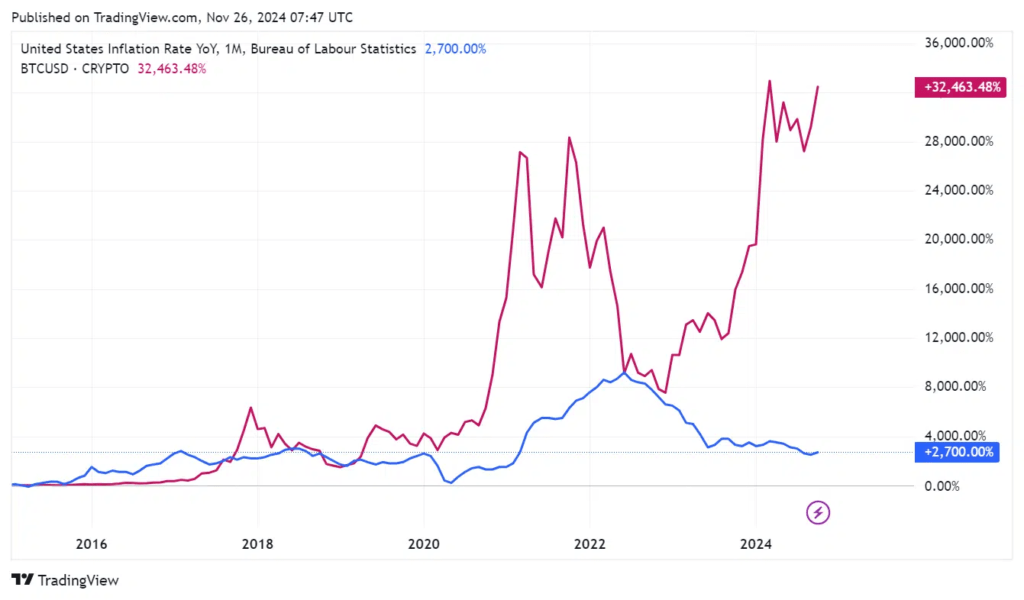

Diagram illustrating the correlation between US inflation rate and Bitcoin price, November 26, 2024 | Source: TradingView

Historically, inflation and economic stress resulting from trade wars between the US and China have disrupted traditional financial markets. During such uncertainty, traders often turn to alternative assets like Bitcoin to hedge against the volatility of traditional assets susceptible to trade wars. This is why Bitcoin is often described as a “safe haven” asset.

Although inflation is detrimental to a national economy, it can positively impact Bitcoin’s growth. For example, during the 2018-2020 US-China trade war, when the US increased tariffs on technology and electric vehicle imports from China, Bitcoin saw increased investor interest and significant price growth. Investors sought to protect their assets from a volatile market, inadvertently boosting Bitcoin’s popularity.

Therefore, increased import tariffs are predicted to have a positive impact on the Bitcoin market and cryptocurrencies in general. The trend of investing in cryptocurrencies to safeguard assets during economic volatility could benefit investors. However, this is a prediction and not a guaranteed outcome; continuous monitoring and updates are crucial for understanding the market.