Summary: This article analyzes the phenomenon of Token Generation Events (TGE) with low circulating supply and extremely high Fully Diluted Valuation (FDV), a challenge currently facing the cryptocurrency market. We will delve into the causes of this trend, its impact on individual investors, and potential solutions to address the issue.

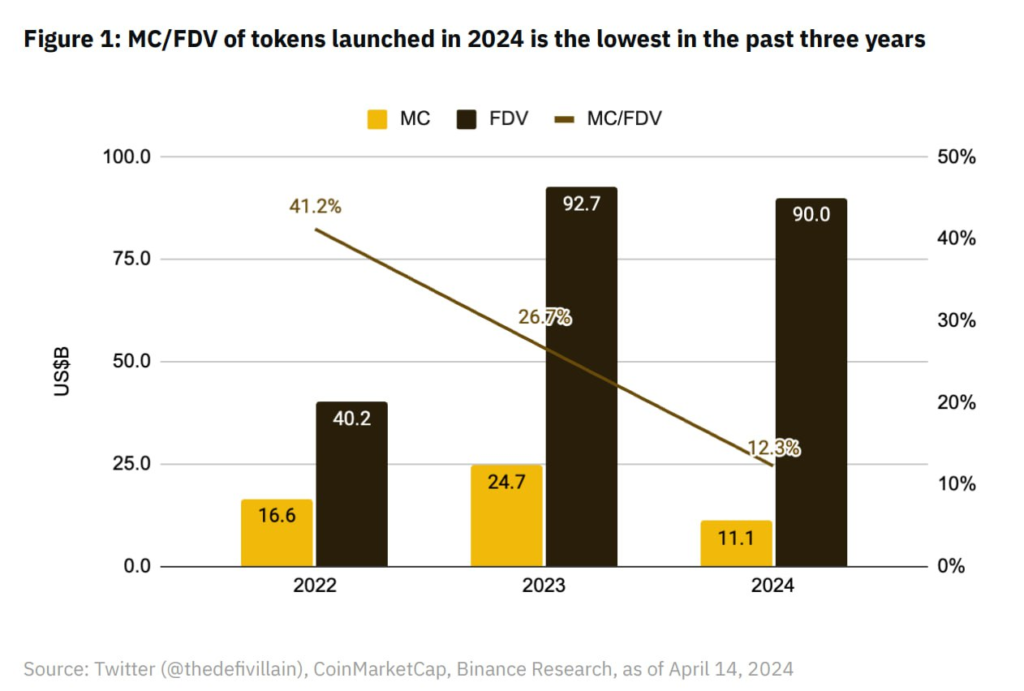

Have you ever wondered why increasingly more new projects launch with extremely high FDV at their TGE? This is a reality, especially in the current market recovery phase following the bear market. According to Click Digital, the stark difference in MC/FDV (Market Capitalization/Fully Diluted Valuation) between newly launched projects and those listed since 2022 has raised concerns for many.

Table of Contents

Reasons for TGE with Extremely High FDV

Two main factors contribute to this phenomenon:

1. Heavy VC Investments:

Everyone is aware of the impact Venture Capital (VC) funds have on the market. New projects are continuously securing funding, raising hundreds of millions of dollars through various funding rounds. Receiving substantial investments helps elevate project valuations, resulting in high TGE prices, sometimes even comparable to the top 20 projects on Coinmarketcap.

Example: Project A, with its cutting-edge blockchain technology, secured $100 million from renowned VC firms like Sequoia Capital and Andreessen Horowitz. This investment significantly boosted the project’s value, leading to a very high FDV at its TGE.

2. Optimistic Market Sentiment:

Optimism here refers not only to the price of Bitcoin and Ethereum but also to positive news surrounding the broader crypto market. The emergence of Bitcoin and Ethereum ETFs from major traditional financial institutions worldwide is one factor driving this optimistic sentiment. It is evident that market optimism encourages VCs to invest more aggressively in projects.

3. Low Circulating Supply:

Beyond these two core factors, another element contributing to high FDV is low circulating supply.

Low circulating supply means that the number of tokens available for trading in the market is highly limited.

This enhances the value of the token as demand exceeds supply.

Newly launched projects often release a limited initial token supply to maintain a high price and create a scarcity effect, further increasing FDV.

Consequences of TGE with Extremely High FDV

The combination of these factors has created challenges for individual investors, particularly those seeking early participation in “Techcoin” projects (projects with breakthrough technology).

Why is it difficult?

- Difficult Entry: With extremely high FDV, token prices are very high, making it challenging for many to secure a good entry point for long-term holding.

- Intense Competition: The increasing number of new projects launching intensifies competition, making it harder to choose promising projects.

- Vast Investment Portfolio: VCs and market makers (MM) have diversified investment portfolios; they don’t necessarily have to push the price of every project, making it more difficult to allocate resources and find profitable opportunities.

Comparison Table of TGE with High and Low FDV

| Feature | TGE with High FDV | TGE with Low FDV |

| Circulating Token Supply | Low | High |

| Initial Price | High | Low |

| Number of Investing VCs | Many | Few |

| Market Sentiment | Optimistic | Neutral or Pessimistic |

| Potential for Price Growth | High potential, but also high risk | Lower potential, but lower risk |

| Challenges for Investors | Difficult to find entry, intense competition | Easy to find entry, but limited price growth opportunities |

| Examples | Project A, with its emerging blockchain technology, received $100 million from reputable VCs like Sequoia Capital and Andreessen Horowitz. | Project B, with a DeFi application, attracted a small number of VCs but boasts a strong community and robust development activity. |

Note: This table is for general comparison purposes. Investing in any project involves risks and requires careful consideration.

Observations

The topic of TGE with high FDV and low circulating supply is a hot topic in the current crypto market. It is clear that the combination of abundant VC funding and market optimism has created a fierce FDV race. However, we shouldn’t get caught up in the allure of these figures and forget the essence of investing. Everyone needs to be cautious and analyze thoroughly before making investment decisions. This topic poses several questions for investors: does FDV truly reflect a project’s real value? Are projects with high FDV actually good investment opportunities? The crypto market is inherently risky, and understanding the factors affecting a project’s FDV is crucial for making informed investment decisions.

Important Considerations

- FDV is a theoretical number: It does not reflect the project’s actual value.

- Change in Circulating Supply: Circulating supply can change over time due to new token releases by projects or the unlocking of locked tokens.

- Thorough Project Research: Dedicate time to thoroughly research the project, development team, technology, and target market.

- Portfolio Allocation: Diversify your investment portfolio across various assets, not just focusing on newly launched projects.

Conclusion

TGE with low circulating supply and extremely high FDV is a concern in the current market. To succeed in this market, investors must be rational, analyze thoroughly, and understand the project before making investment decisions.

Everyone should remember that selecting a good project involves more than just FDV or VC investments. It also requires careful consideration of technology, the development team, community, and project roadmap.